What Is SST Malaysia? 2025 Tax Guide & Updates

What Is SST Malaysia? 2025 Tax Guide & Updates

Sales and Service Tax (SST) in Malaysia is an important element in the tax system of the country. In 2018, SST, which replaced the Goods and Services Tax (GST), is expected to ease the burden on the consumer and to make goods and services more cost-effective. By 2025, SST will remain the basis of indirect taxation in Malaysia. This detailed guide review outlines all the key information about SST: what it is, how it is structured, what are the rates, how to comply with it, and the effects on businesses. Its recent developments on the changes that will be made to sales tax rates as of 1 July 2025 have been also stated.

Overview of SST in Malaysia

The Sales and Service Tax (SST) is divided into two different components:

-

Sales Tax: the tax levied at the manufacturing and importation of goods level of what is manufactured and imported.

-

Service Tax: It is charged on the payment of some of the specified services given by the taxable persons in Malaysia.

The two taxes are issued under different legislations:

-

Acts 2018 No 13 Sales Tax Act

-

Service Tax Act 2018

The Royal Malaysian Customs Department (RMCD) is the body with powers to administer SST.

Sales Tax: Scope, Rates, and Applicability

What Sales Tax is?

Sales Tax in Malaysia is directly imposed on a taxable commodity which is either produced or imported to the country. It is not paid at all points during the supply chain but only when it is manufactured or imported.

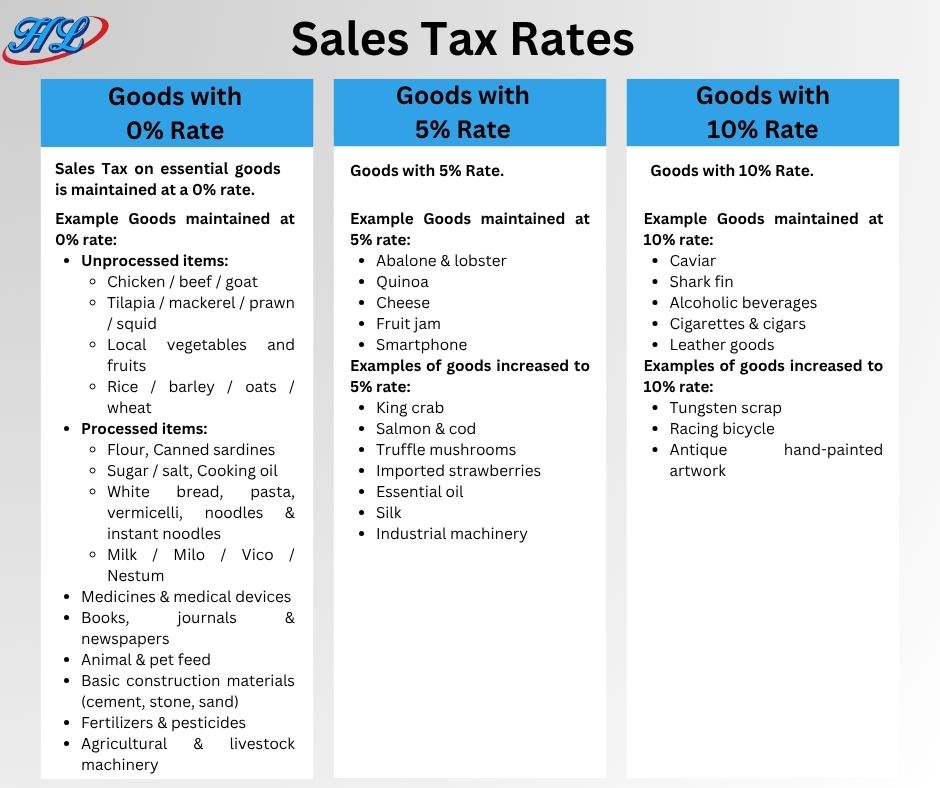

Sales Tax Rates (Updated 2025)

On 1 July 2025, Malaysia changed its Sales Tax rates:

-

5%- It is charged on necessities and less valuable commodities

- 10% Which is imposed on the majority of the standard manufactured goods

- Specific rate RM per unit on items of choice (e.g. beverages, petroleum)

Tax rate is imposed based on the date of issuance of the invoice or date of customs clearance where the date on which the product is produced or bought does not determine the tax rate.

Examples:

- Invoice created before 1 July 2025- old rate will be applied

- An invoice that was issued on/after 1 July 2025- needs to be dealt with under the new rate

Taxable Goods

Items subject to sales tax are:

- Locally produced goods excluding the exemptions

- Any imported goods unless given an exemption in the Sales Tax (Goods Exempted from Tax) Order 2025

Basic foodstuffs, medical equipment and reading materials are usually not taxed.

Own Use or Disposal of Manufactured Goods

Even where the registered manufacturers consume or discard goods within themselves, they must charge SST e.g. :

- Promotional giveaways

- Consumption or in house testing

- CSR/ free sampling

Where the use/disposal is on or after 1 July 2025, the new tax rate is applicable despite the time at which the company had incurred the same in its books of account.

Example:

- Goods registered with own use 25 May 2025

- Physical consumption on 15 July 2025 10% tax will be applicable (Ref: Situation 7, Customs Guideline)

Sales Tax Exemption for Manufacturers

Effective 1 January 2026

Registered manufacturers are exempted from Sales Tax on critical raw materials, including:

• Fertilisers

• Animal feed

• Pesticides

Service Tax- Scope, Rates and Applicability

What Is The Service Tax?

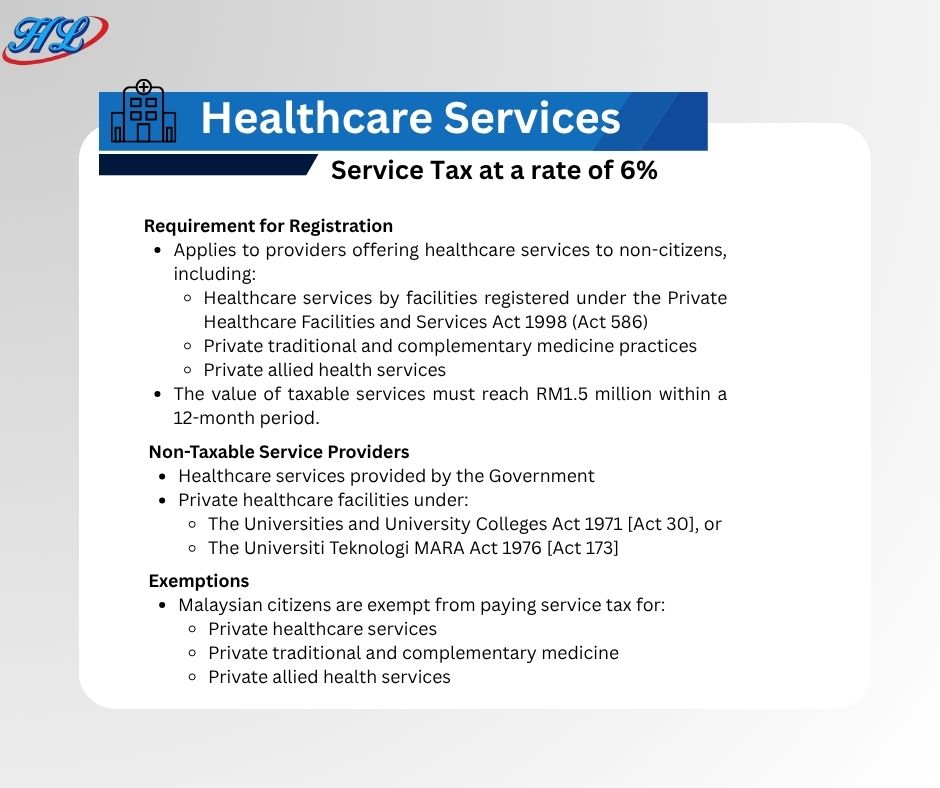

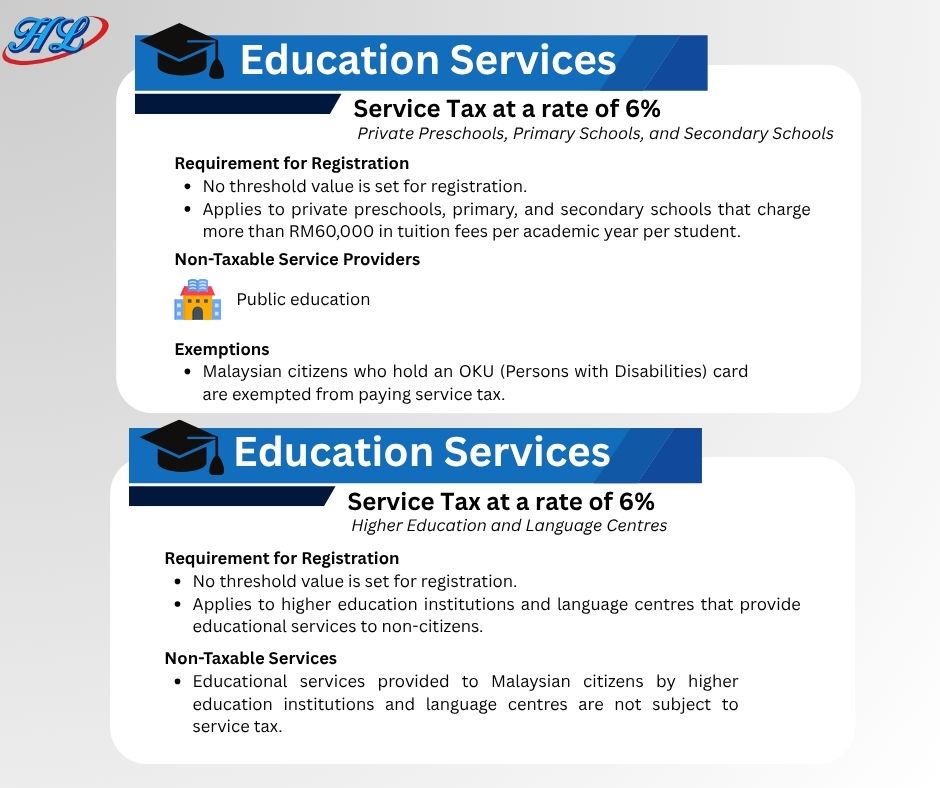

Service Tax is charged on the taxable services provided in Malaysia by a registered person. It is an end consumption tax.

Service Tax Rate (2025)

As of 2025, the normal Service Tax charge will be 6%, but there will be further expansion of scope:

- Logistic services and courier services have become taxable now

- Foreign online service providers (e.g. Netflix, Spotify) have to be registered

Taxable Services

Some worth mentioning lines of taxable services are:

- Hotel, accommodation

- F&B (cafes, restaurants)

- Professional service (lawyers, accountants)

- Telecommunications (internet, mobile services)

- Insurance Takaful

- Streaming and online services

Updated Service Tax Rates (2025)

Exempted Services

Public Transportation Services

Public transportation remains fully exempt from service tax. This includes:

- Rail services (MRT, LRT, KTM)

- Stage and express buses

- Ride-hailing services (e.g. Grab)

- Ferry and water taxis for public use

Who Must Register for SST in Malaysia?

Registration Thresholds

|

|

|

|

|

|

|

|

|

Registration can be done online via MySST Portal.

Registration Requirements

After the registration, businesses have to:

- Sell SST when it is applicable

- Pay SST-02 returns after every two months

- Keep, as a matter of records, 7 years

Disposal & Exemption Considerations

There are some manufacturers who are exempted to SST registration, e.g:

- Repackaging bulk products to small packages

- Non-improving Nature by cutting materials

- Internal outlet supply by Central kitchens

Example:

- STU Sdn Bhd repackages mangoes → not subject to registration (Ref: Situation 12, Customs Guideline)

Digital Tax and SST

The Digital Service Tax (DST) was first introduced in January 2020, and is directed at foreign providers of digital services:

- Subscriptions (e.g., Netflix)

- E-commerce platforms

- Cloud storage

Registration under the Service Tax Act is necessary in case annual revenue of Malaysian users goes beyond RM500,000.

Compliance, Filing, and Penalties

Filing

- SST-02 due: the last day of the month at the end of the taxable period

Payment

- Through MySST portal

- Approved payment channels or bank transfer

Record-Keeping (7 Years)

- Invoices

- Credit/debit notes

- Records in imports/exports and sales

There is late payment penalty:

- Between the first to 30 days late: 10% penalty charges over the outstanding SST amount.

- The following 30 days (day 31- 60) → Additional 15%.

- The following 30 days (day 61- 90) → Additional 15%.

Total:

- When you are late by 91 days or more, the fine goes to the highest of 40%.

Benefits and Challenges of SST

Advantages

- Easier in case of SMEs

- Reduced cost of compliance

- Pricing which is more predictable

Challenges

- No cascading effect (input tax credit)

- Tax base

- Dual compliance of mixed suppliers

For more information and detail, visit Guidelines For The Transition Of Sales Tax Rate Changes.

FAQ

1 July 2025. Invoices issued or goods cleared through customs on or after this date will follow the new rate.

Refer to the Sales Tax (Rate of Tax) Order 2025 and Sales Tax (Goods Exempted from Tax) Order 2025 on MySST.

You still need to account for SST if you're a registered manufacturer. The tax applies at the time of use or disposal.

If your total taxable turnover exceeds RM500,000, yes. This includes online sales and digital services.

Yes. Voluntary registration is allowed for both Sales Tax and Service Tax if you're engaged in taxable activities.

Penalties range from 10% to 40% depending on the number of days overdue.

Jun 24,2025